Jumpstart

BOUNCE BACK FROM AN EARTHQUAKE

BUILDING RESILIENCE

Jumpstart is event triggered, super fast, lump-sum payouts, for catastrophic events – starting with Earthquakes in California.

Building community resilience to natural disasters, by providing affordable coverage that gives instant lump-sum payouts with no deductible, is at the heart of Jumpstart’s mission.

FOUNDER

Kate Stillwell (CEO) – has 10 years experience as a practicing structural engineer and 7 years in earthquake risk modelling. She was also Founding Executive Director of the Global Earthquake Model Foundation (GEM).

PROBLEM

Less than 10% of California state’s 12.5m households hold quake insurance.

Incumbents’ products are perceived as overly-complex, opaque and slow.

SOLUTION

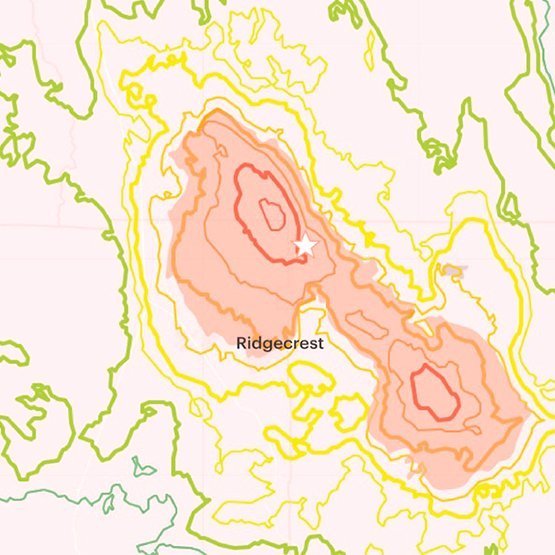

Customers pay a low monthly premium. If their insured location experiences the parametric trigger, Jumpstart will deposit a lump sum of $10,000, right away, no strings attached, straight to their bank account.

“Natural hazards are only the beginning. The change we want to see in the world is for index-based ‘parametric’ insurance to become so widespread that ‘Jumpstart policy’ becomes a generic term for any coverage with fast, fixed payouts. The current premiums for CA EQ are $600 million. Jumpstart aims to double this while expanding to other earthquake-prone states and other perils”

Kate Stillwell, Founder at Jumpstart

Natural Disaster Resilience Report

More than two in five Americans worry about their community in a natural disaster Nearly three in five Californians impacted …

San Francisco Business Times: Jumpstart

Bay Area residents aren’t prepared for the next earthquake. This startup wants to change that “Kate Stillwell doesn’t want to …

Willis Towers Watson: Parametric Case Studies

“In this edition of the Quarterly InsurTech Briefing, we look at event-based, or “parametric,” insurance offerings and ask ourselves whether …