AI is one of the most significant technological advancements of recent times, with Large Language Models (LLMs) at the forefront of the innovation. The potential impact of AI is currently being analysed by the venture market and various industries, as early adopters position to capture value. In this context, Simon O’Dell from Insurtech Gateway Australia explores the use of LLMs in insurance, highlighting a recent investment in the advanced AI start-up, Uncapt.

“Advanced AI is here, undeniable, and growing.”

Uncapt

Meet the founders of Uncapt

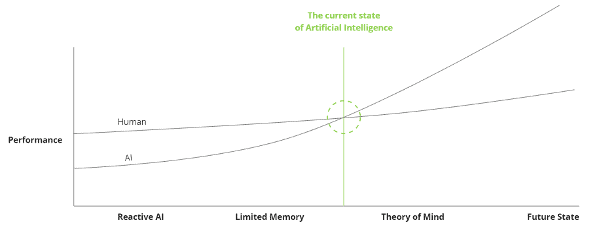

As founders that have practised AI for over 10 years, Ebenezer Eyeson-Annan and Jalal Radwan find themselves as technical experts in a domain that is now the focus of attention across the venture and business world. Current-state AI sits across a large chasm from practical business applications, leaving a gap in the market that represents the opportunity for start-ups like Uncapt.

Uncapt opportunities for Insurance and Industry

In an office environment, most activities can be done more efficiently and with better outcomes by utilising advanced AI. From compiling and coordinating communications to data processing, emails, transactions, reconciliation, reporting, benchmarking, decision making, and negotiating, AI has the potential to optimise and scale critical business functions.

Uncapt is already creating value for SME and enterprise-level clients in the FMCG sector, but they also have their sights set on applications in the insurance industry. There are various opportunities for AI in insurance, including the use of different forms of AI, not just LLMs and natural language processing.

For early adopters, LLMs are creating significant value across the insurance value chain, including:

- customer experience

- claims processing

- underwriting and risk assessment

- accessing new markets, as well as

- operational and value chain efficiency.

Opportunities for LLM-powered innovation

One of the most promising areas for LLM-powered innovation in the insurance industry is in customer experience. With the ability to understand and respond to natural language inputs, LLMs can enable insurers to create conversational interfaces that make it easier for customers to find the information they need and interact with their insurance providers.

In addition, LLMs can help insurers automate the process of reviewing and approving claims by using natural language to extract key information from claims documentation. This can reduce the time and resources required to process claims and improve the overall claims experience for customers.

LLMs can also be used to improve underwriting and risk assessment. By analyzing large amounts of data and identifying patterns that indicate risk, LLMs can help with portfolio monitoring and ultimately optimised risk metric performance.

Moreover, conversational interfaces powered by LLMs can help reduce operational costs by allowing workers to interact with customer relationship management (CRM) systems and other data sources in a more natural and intuitive way, eliminating the need for workers to navigate through complex menus or manually enter data into the system. Conversational interfaces can also be integrated with other systems such as claims management systems and underwriting systems, which allow workers to access data from multiple sources in a single interface.

Overall, the potential for innovation in the insurance industry through the use of LLMs is significant. As AI start-ups continue to develop and refine these powerful technologies, we can expect to see a wide range of new applications that will help insurance players better serve their customers and drive genuine innovation in the industry.

Get in touch

If you are an outsider with a big idea or have already founded a pre-seed or seed insurtech, we have the experience and the tools to help you launch and scale faster. Check out our incubator and venture fund or get in touch